Family Limited Partnership Discounted Gifting May Soon Be Coming to an End

August 25, 2016

Leonard M. Friedman, CPA/ABV, CBA

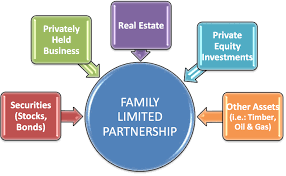

Family Limited Partnerships (FLP’s) can be useful family wealth management tools for estate planning purposes but can also be used to protect family members from mismanagement of wealth and even marital claims. They are generally funded with marketable assets and real estate but many have family business interests in them as well. The Internal Revenue Service (IRS) wants to put a cramp in using these vehicles to reduce estate taxes.

The IRS has released long expected proposed regulation changes to code section 2704 regarding family limited partnerships (FLP) or family holding companies and the use of minority and lack of liquidity (marketability) discounts.

The minority and marketability discounts have been used for years in estate planning to lower the value of a gifted minority interest to family members in a FLP. The following illustrates the estate tax savings that these gifts create:

Value of 100% of Family LP $ 10,000,000

Gifted Interest 10% 1,000,000

Assumed Discount to the Value 30% (300,000)

Value of Gifted Interest $700,000

The person who gifted the 10% (assuming they had control prior to gift) just relieved their estate of $1 million of assets but the gift was valued to the recipient at $700,000, which is what is listed on the gift tax return. The $300,000 gift discount likely will save $135,000 using a 45% tax rate. And, the assets’ future growth will be out of the estate as well. The plan over time is to gift in minority (less than 50%) increments to the point where no one individual has control at their time of death, and when they pass they have just saved the estate a bundle of money.

The IRS is trying to put a stop to this because they conclude that every time the FLP structure is used, it is merely devised to avoid estate taxes. However the lack of language barring this in the tax code has caused the IRS to lose virtually all tax court cases because each gifted interest stands on its own when considering valuation. The IRS has added language to the regulations to basically bar discounts for intra-family gifts where the family still owns control after the gift.

There is a limited amount of time left to take advantage of the old rules. Many experts and attorneys I have talked to believe the ban on most discounts will become final but others think that Congress will overrule the changes to the regulations, and some commentators feel that the proposed regulations are an overreach and may be successfully challenged. Right now we are in a 90 day public comment period that will end on December 1, 2016. Final regulations will become effective soon after.

If you are considering implementing the FLP vehicle and you have an estate of greater than $5.4 million ($10.8 million for Husband/Wife) then you should contact us to advise you. While this is only relevant to taxpayers who have taxable estates, Democrats have proposed reducing the taxable estate from $5.4 million to a much lower number. So, this may become relevant to more people whose estate isn’t taxable now but may become so if the exemption limits are lowered.

RRBB eNEWSLETTER

Get free tax planning and financial advice