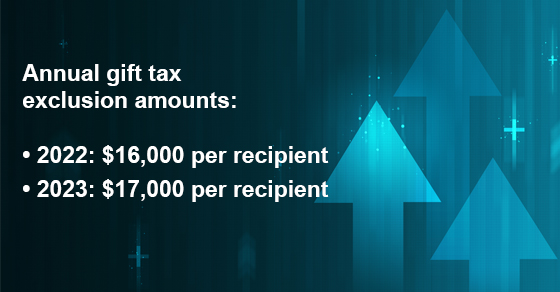

Annual gift tax exclusion amount increases for 2023

Did you know that one of the easiest and most convenient ways to avoid paying estate taxes is also one of the most effective? You can give loved ones a sizable amount of assets tax-free during your lifetime by making the most of the annual gift tax exclusion. The sum for 2022 is $16,000 per recipient. The sum will rise by $1,000 in 2023 to $17,000 per beneficiary.

Maximizing your gifts

Contrary to popular belief, a gift’s giver is responsible for paying federal gift tax, not the recipient. However, with the typical gift structure, they are at least partially exempt from gift tax. They fall within the annual gift tax exclusion and, if necessary, the unified gift and estate tax exemption for sums that exceed the exclusion. However, using the unified exemption while you are still alive reduces the amount of potential estate tax protection.

For 2022, you are exempt from gift taxes up to $16,000 per recipient per year. So, for example, you may gift each of your seven grandchildren up to $16,000 at year’s end, for a total of $160,000, provided you have three adult children and seven grandchildren. Then, for a total of $170,000, you can give each person $17,000 starting in January 2023. In this case, you may, in a couple of months, lower your estate by a total of $330,000.

Each taxpayer has access to the annual gift exclusion, too. However, the exclusion limit effectively doubles to $32,000 per recipient in 2022 ($34,000 in 2023) if you’re married and your spouse agrees to a joint gift, often known as a “split gift.”

Remember that divided gifts and sizable gifts necessitate IRS reporting requirements. If you exceed the yearly exclusion limit or give gifts jointly with your spouse, you must file a gift tax return. Sadly, submitting a “joint” gift tax return is impossible. In other words, each spouse must submit a separate gift tax return the year they both make gifts.

Coordinating with the lifetime exemption

The combined gift and estate tax exemption includes the lifetime gift exemption. Gifts that exceed the annual gift tax exclusion may be protected from taxation. According to the legislation, the exemption shields $10 million from taxation, inflation-adjusted. The sum is $12.06 million in 2022, and it will rise to $12.92 million in 2023. However, as was already indicated, using your lifetime gift tax exemption reduces the amount of exemption left for your estate.

Be aware that some gifts are exempt from gift tax, keeping the entire yearly exclusion limit for gift tax and the exemption amount. These consist of gifts:

- From one spouse to the other,

- To a qualified charitable organization,

- Made directly to a healthcare provider for medical expenses, and

- Made directly to an educational institution for a student’s tuition.

For instance, you might pay the college directly the tuition for a grandchild’s forthcoming school year. The annual gift tax deduction will not apply to the donation.

Make the most of the annual gift tax exclusion

Your estate planning arsenal still has the annual gift tax exclusion as a potent tool. For assistance creating a gifting plan suitable for your particular circumstance, contact our RRBB accountants and advisors today.

© 2022

RRBB eNEWSLETTER

Get free tax planning and financial advice